For a startup business, getting enough funding is one of the keys to its success. But investors won’t just readily bankroll your business like that. They would also want assurance that their money is used correctly and that they will get their desired returns on the investment.

That is where proper fund management becomes an important business task. And for it to work out, you need to put effort into it. Let’s explore some ways you can effectively handle your funding and boost your business with it.

Your Startup Business’s Sources Of Funding

There are various ways you can get funding for your startup. Each of these funding methods has its expectations you need to fulfill. Hence, your fund management strategy should start with understanding what funding options you have at the table.

Personal Investment

This type is arguably the first funding most startup businesses begin with. But beyond providing the first seed for the venture, your investment also serves as a signal to potential investors. It tells them you have a strong commitment to the long-term development of your business.

Image from Exquisite Magazine.

Image from Exquisite Magazine.

On the other hand, personal investments are arguably the funding source you can get most attached to. After all, it is your hard-earned money. As such, you might become hesitant putting it on the line for the venture. That can result in some difficulties getting the business to take off.

Love Money

Another typical source of initial funding, this one is the money your family and close friends provide to support you. Like your personal savings, you may be more thoughtful handling this investment, as they come from people you care for. Depending on the arrangement, your friends or relatives get part ownership of the business in return for their investment. While you can do that verbally, you should still do it formally for proper management.

External Funding

This is the biggest funding source your startup business will have moving forward. All provide you with continuous funding in exchange for a portion of the company’s profits. They could also get partial ownership based on the financing they provide.

You have a variety of options for external funding. Some of the most common ones startups employ include the following.

- Venture capitalists: These investors primarily help fledgling businesses in exchange for an ownership share. They opt for startups that already have shown significant profitability.

- Angels: In contrast to venture capitalists, angels invest in small firms primarily to help them. They also provide expert knowledge in exchange for having a say on management policies.

- Business incubators: These investors provide more than financial help for businesses. They can also lend facilities to accelerate the development of your products.

- Grants: Government agencies or non-government organizations award these as assistance for emerging businesses. They can be difficult to get due to strict criteria from the grant provider.

- Bank loans: While they are more accessible, businesses have to maintain a good track record of paying back the loans.

- Equity offerings: Short of going public, your startup can also sell stock to individuals. This type does require careful oversight by your legal department.

Depending on your business circumstances, you might opt to use a combination of any of these options. A sound fund management strategy will help you oversee all these funding sources and effectively coordinate with investors to meet their demands.

Developing Your Startup Business Fund Management Strategy

When building your fund management strategy, it isn’t just about handling the cash given by investors. You should also show them that the venture will indeed be a success and they will get their returns. For that, here are some essential things you should consider.

Capital Preservation Is Vital

One thing that you need to understand about investors is that they take calculated risks when making investments. In particular, they expect to get their money back from each investment. With that, you want to ensure that capital is indeed preserved.

Image from Realized.

Image from Realized.

There are various ways that you can do that. For instance, you can already allot a portion of your earnings to servicing capital returns. Talk with investors to determine how much would be suitable to maintain their capital.

This matter also plays a role when considering the risks of a new investment your startup business intends to make. Assure investors that such investments would also succeed. Additionally, you want to demonstrate that their additional capital outlay would bear fruit.

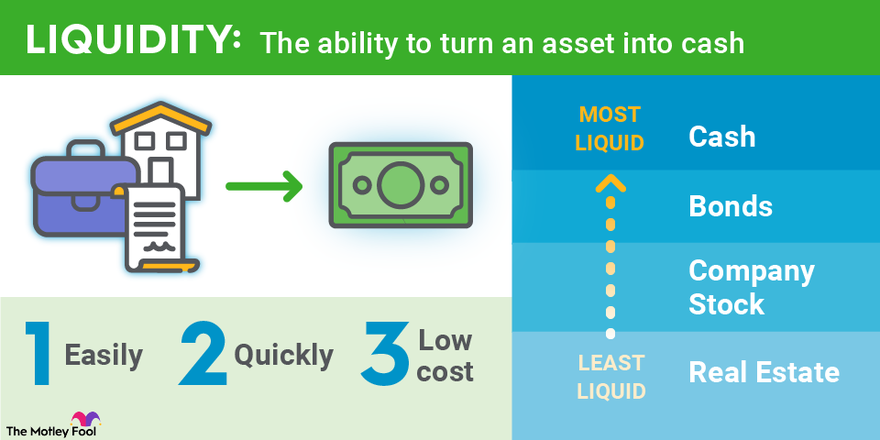

Liquidity

The startup business scene can be an uncertain environment at times. While your venture might be in a good position one moment, you might find yourself cash-strapped the next. Here, you need to ensure that there is some form of built-in liquidity that will let you free up cash quickly.

Image from The Motley Fool.

Image from The Motley Fool.

However, you still have to inform investors of such liquidity. That helps assure them that their cash will not move unexpectedly. Additionally, that information helps them gauge the health of the venture and gives you useful insights.

Cost Management

If you have bank loans as part of your financing scheme, you need to consider the added costs of taking these loans. For instance, there might be minimum balance charges when converting your treasury bills into actual cash. Make sure you understand the full terms of these loans to help you anticipate these extra charges.

Helping Your Startup Business Manage Its Funds Effectively

Doing all this fund management stuff can be a lot of work. And since you already have your hands full with other business tasks, Virtua Solutions is ready to take that work off your load. Our virtual assistants can jump in and handle the work for you.

To start, our VAs will be handling all that paperwork related to funding management. We go through all the documents to ensure they are filed correctly and submitted to relevant authorities. Additionally, we can do basic ledger work to help in the accounting of funds.

Beyond that, we can assist you in meeting with investors. Our team understands how vital these engagements are and will ensure that your schedule is organized to accommodate them. During the meetings, our VAs will also provide clerical support as needed.

Keep Your Startup Business Thriving By Managing Your Funds Right

Proper fund management isn’t just about setting your finances right. It is also about gaining the trust and confidence of your investors. And with our help, you can earn those faster. Contact us today and let us lend a hand in making your business more profitable.